Expert predicted bitcoin reversal due to increased global liquidity

The cryptocurrency market is preparing for an upward trend reversal in light of money supply growth. Former Goldman Sachs top manager and macro investor Raul Pal stated this on the Real Vision podcast.

The specialist stressed that bitcoin depends more on the dynamics of money supply (M2) than on halving. The latter is not necessary if there is an influence of the first factor.

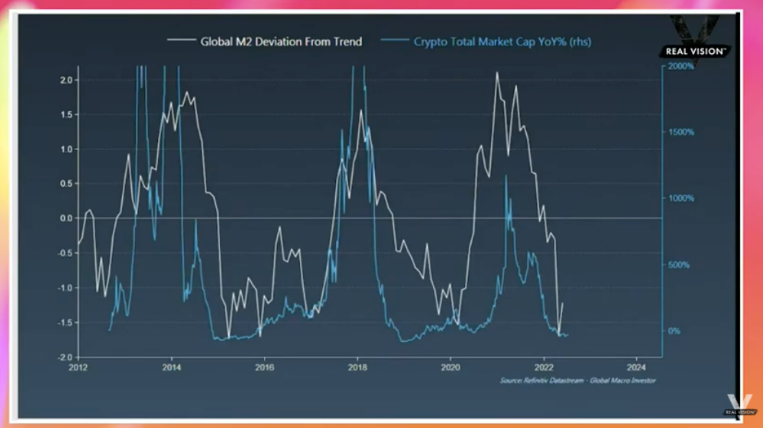

“Digital assets are independent of the business cycle, but their behavior is tied to global liquidity flows. There is currently a divergence of M2 from the trend by about one and a half standard deviations, and it is getting stronger,” he shared his observations.

The expert explained that the formation of extremes of the macroindicator preceded the reversal of trends in the cryptocurrency market.

“Remember that bitcoin is not a cyclical asset. It won’t go back to where it was, like oil or other commodities. It’s a network implementation model that grows over time according to these wide fluctuating ranges,” Pal explained.

Recall that Grayscale analysts have assumed the end of cryptozyme by the end of March 2023.

Earlier, Pal predicted the growth of Ethereum to the $20,000 mark.